In depth

Delaware's adoption of Senate Bill 21/Senate Substitute 1 transforms elements of its corporate law, addressing critical aspects of governance and oversight. The updates include the establishment of new statutory safe harbors for related party transactions, provisions for controlling stockholder exculpation and narrowed stockholder information rights, a clarified definition of "Controlling Stockholder", and, in certain circumstances, a presumption of director independence. The amendments retroactively apply to all covered acts and transactions, whether occurring before, on, or after their enactment, except for any action or proceeding completed or pending, or any demand to inspect books and records made, on or before February 17, 2025. This Alert explores these amendments and their implications.

1. DGCL §§ 144(d)(4) and 144(e)(2): Statutory clarification of who will constitute a "Controlling Stockholder".

A definition of "Controlling Stockholder" was added to DGCL § 144(e)(2). This definition generally limits control to a person that, together with such person's "affiliates" and "associates" (which are not defined in the statute):

- Owns or controls a majority in voting power entitled to vote generally in the election of directors or in the election of directors who have a majority in voting power of the votes of all directors (or has that right by contract); or

- Has ownership or control of at least one-third in voting power entitled to vote generally in the election of directors and has the power to exercise managerial authority over the business and affairs of the corporation.

Previously, a Delaware court's determination of whether a person was a controlling stockholder was often based on whether the stockholder had the ability to exercise control over the corporation's business and affairs, even if they did not own a majority of the voting power. The courts looked at various factors, including the ability to influence the board of directors, the presence of contractual rights, and the overall context of the control exerted. The new definition provides a more concrete standard for determining who qualifies as a controlling stockholder, reducing the ambiguity that existed under the previous case law.

2. DGCL § 144(d)(2) – (3): Creation of a presumption of director disinterest in a transaction based on stock exchange rules.

The amendments, via DGCL § 144(d)(2), also add a presumption of disinterest for any public company director who is not party to the relevant transaction and who the board has determined satisfies applicable stock exchange rules regarding independence as well as any specific independence criteria specified by the corporation.

When assessing the disinterest of a director with respect to a conflicted controlling stockholder, the stock exchange test is applied as if such controlling stockholder is the corporation. The designation, nomination or vote of a controlling stockholder in the election of a director to the board of directors is not, in and of itself, evidence that a director is conflicted with respect to a transaction in which the controlling stockholder is conflicted.

Any presumption of independence is "heightened" and may only be rebutted by substantial and particularized facts that a director has a material interest in the act or transaction or has a material relationship with a person who has a material interest in the act or transaction.

Over the past few years, some Delaware court decisions have questioned director disinterest as a result of what some observers have characterized as non-material, non-economic connections to a controlling stockholder. These critics claim that such court decisions undermine predictability for corporations attempting to "do the right thing" by delegating decisions to disinterested special committees. By tying director independence to established stock exchange rules, the hope is that there will be less judicial second guessing of independence assessments. This approach has at least some roots in Delaware case law. Delaware courts have long found stock exchange independence rules to be useful in assessing disinterest under Delaware law. See., e.g., Kahn v. M & F Worldwide Corp.

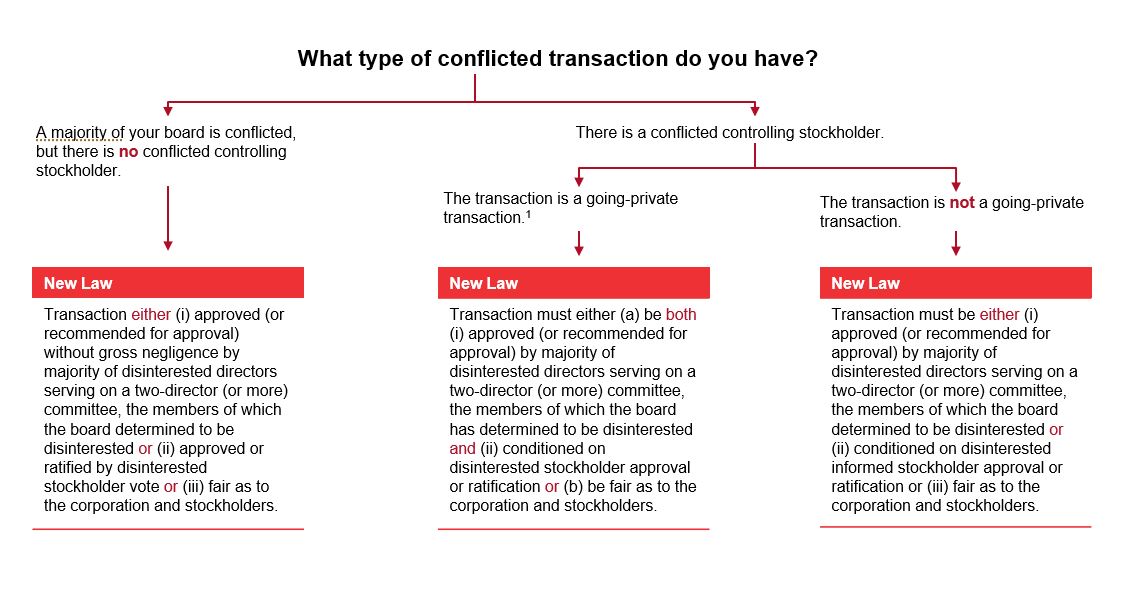

3. DGCL § 144(a) – (c): Additional statutory safe harbors in conflicted transactions that lower previous requirements under case law.

Previously, DGCL § 144(a) provided a mechanism to protect transactions involving director conflicts of interest from being deemed void or voidable solely on the basis of a conflict. This old safe harbor was considered by some to be insufficient because:

- While the historic safe harbor shielded such transactions from being voided solely due to conflicts, the transactions that qualified for the safe harbor remained subject to legal challenges related to alleged breaches of fiduciary duty; and

- The statutory safe harbor did not address transactions involving a conflicted controlling stockholder.

The newly adopted amendments provide safe harbors for situations involving both conflicted directors and conflicted controlling stockholders. In addition, compliance with these safe harbor provisions now offers broader protection, explicitly barring monetary damages and equitable remedies against directors, officers and controlling stockholders of a corporation.

These amendments roll back jurisprudence expanding the application of the "MFW Doctrine" promulgated through case law following the Delaware Supreme Court's decision in Kahn v. M & F Worldwide Corp. Under the MFW Doctrine, a conflicted controlling stockholder transaction would not receive the benefit of the business judgment rule unless such transaction was conditioned, ab initio, on approval by both (1) an independent, fully functioning special committee of independent directors and (2) a majority of disinterested stockholders. Critics alleged that the doctrine was so burdensome and prone to foot faults that it caused corporations to resort to defending their transaction under the entire fairness standard of review rather than being allowed to take advantage of the court-created safe harbor.

If an independent committee is used to take advantage of the safe harbor, the safe harbor will remain available even if a court ultimately disagrees with the board's independence determination, so long as (1) there are at least two directors on the committee who are ultimately found to be disinterested and (2) a majority of such disinterested directors on the committee approved the transaction in good faith and without gross negligence.

Practice Tip: Delaware corporations should review their conflicted transactions to determine the best method for approving or ratifying such transactions under the newly created statutory safe harbors. This would protect them from stockholder lawsuits seeking to challenge such transactions. That protection could be particularly helpful for corporations looking to undertake capital market transactions, investment transactions or change in control transactions, as it would eliminate potential concerns from underwriters, placement agents and counterparties as they perform their due diligence.

4. DGCL § 144(d)(5): Controlling stockholders automatically exculpated from monetary liability for duty of care breaches.

The adopted amendments also exculpate, without any need to amend a certificate of incorporation, controlling stockholders from monetary liability to the corporation or its stockholders, unless the liability is for:

- Breach of the duty of loyalty to the corporation or other stockholders;

- Acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; or

- Any transaction from which the person derived an improper personal benefit.

Under current Delaware case law, controlling stockholders owe fiduciary duties, including the duty of care in certain situations. But under the old version of the DGCL controlling stockholders were not granted exculpation rights similar to exculpation granted to directors and officers. Under the amended DGCL § 144(d)(5), a controlling stockholder will no longer be exposed to potential monetary damages for breaching the duty of care. This controlling stockholder exculpation provision differs from the exculpatory provision for directors and officers in DGCL § 102(b)(7) as no "opt-in" term in the certificate of incorporation is needed for DGCL § 144(d)(5) to have effect.

5. DGCL § 220: New procedural standards applicable to stockholder books and records demands and reduced scope of stockholder information rights.

DGCL § 220 provides stockholders with qualified rights to inspect the books and records of Delaware corporations. Recent court decisions in Delaware have expanded stockholder inspection rights, leading to an increase in requests for a broader range of corporate documents, including communications by directors, officers, and management. In some instances, courts have allowed access to these records. The enacted amendments to DGCL § 220 narrow stockholder access to corporate records while imposing stricter requirements for such requests.

- Books and Records Definition: The amendments specify that "books and records" include key corporate documents like charters (including any document incorporated by reference into such charter), bylaws, meeting minutes, signed stockholder consents, formal communications to all stockholders, board and committee materials, annual financial statements, agreements entered into under DGCL § 122(18) with current or prospective stockholders, and director independence questionnaires. Communications such as emails and text messages from directors, officers, and management are notably excluded.

- Time Limitation: The amendments establish a three-year look back period for which stockholders can request access to records for most categories of information.

- Demand Requirements: Stockholders must now articulate the purpose of their request and describe the records they seek with "reasonable particularity," possibly setting a higher bar than the existing "credible basis" standard developed under Delaware case law. See AmerisourceBergen Corp v. Lebanon Cty Employees' Rt Fund.

- Confidentiality Protections: Corporations are explicitly authorized to enforce confidentiality, use, and distribution restrictions on accessed records. Produced materials may also be incorporated by reference into legal complaints, allowing courts to evaluate full context rather than selectively quoted excerpts. Additionally, corporations can redact information unrelated to the stockholder's specified purpose.

- Judicial Exceptions: If a corporation does not have the enumerated "books and records", a court may order the corporation to produce additional records of the that are the functional equivalent of any such books and records, but only to the extent necessary and essential to fulfil the stockholder's purpose. A court may also order the production of other types of records, but only if other specific records of the corporation only if (1) the demanding stockholder has made a showing of a compelling need for an inspection of such records to further the stockholder's proper purpose, and (2) the stockholder has demonstrated by clear and convincing evidence that such specific records are necessary and essential to further such purpose. Time will tell whether this becomes the exception that swallows the rule.

* * *

While this Alert is not an exhaustive list of the amendments to Sections 144 and 220 of the DGCL adopted this week, it highlights key provisions. The full text of the adopted bill is available here.

1 The amendments define going private transactions as (1) a Rule 13e-3 transaction as defined in 17 CFR § 240.13e-3(a)(3) (or any successor provision) for a corporation with a class of equity securities subject to § 12(g) or 15(d) of the Securities Exchange Act of 1934, or (2) any controlling stockholder transaction, "including a merger, recapitalization, share purchase, consolidation, amendment to the certificate of incorporation, tender or exchange offer, conversion, transfer, domestication or continuance, pursuant to which all or substantially all of the shares of the corporation's capital stock held by the disinterested stockholders (but not those of the controlling stockholder or control group) are cancelled, converted, purchased, or otherwise acquired or cease to be outstanding."