In more detail

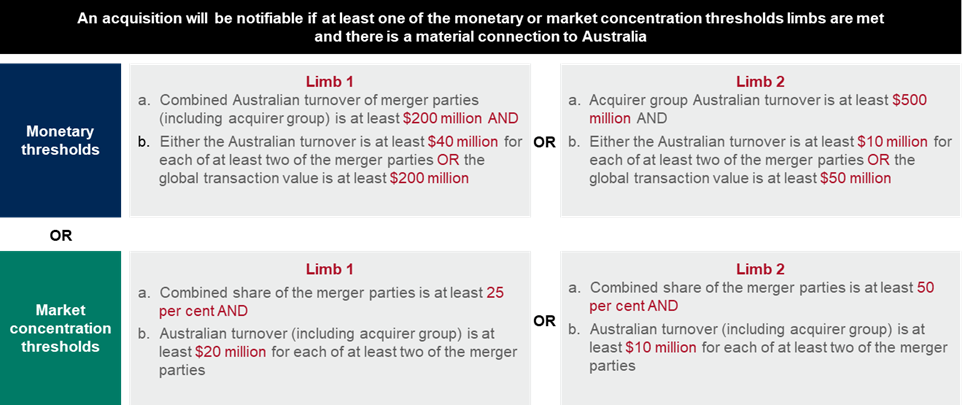

The proposed merger notification thresholds comprise a combination of monetary and market concentration thresholds. The proposed thresholds are set out in the chart below, published in the consultation paper.

The consultation paper notes that the proposed thresholds are based on international practice and available ACCC data. The thresholds are intended to target anti-competitive and economically significant acquisitions, including serial acquisitions, and ensure that there is appropriate scrutiny by merger parties that have substantial market power.

The consultation paper acknowledges concerns that market share thresholds can create uncertainty in a mandatory merger control regime and that for this reason are generally not recommended as part of a mandatory system. To provide certainty, the Government is considering establishing a notification waiver process that would allow merger parties to seek a 'notification waiver' from the ACCC. The waiver will be granted in the ACCC's discretion and will be binding on the regulator with respect to the mandatory notification obligations (but would not prevent the ACCC from subsequently taking action for an anti-competitive merger).

Outside of these notification thresholds, the Minister will be empowered by legislative instrument to require certain high-risk acquisitions to be notified if they fall in industries characterised by high market concentration or high barriers to entry or expansion. The Minister will be guided by reports or advice from the ACCC and will undertake a consultation process before making a determination.

Merger parties will be able to voluntarily notify acquisitions to the ACCC that fall below the proposed thresholds so to obtain regulatory certainty.

The consultation paper notes that as part of this new system the ACCC will publish guidance on the processes and application of the new system, which will enable businesses to transition into the new system with more certainty and predictability.

If you have any questions about the proposed changes to Australia's merger control system, or are interested in making a submission, please contact us.

For more information about the new mandatory suspensory merger control system due to come into effect from 1 January 2026, please see our previous client alert here.

This alert was prepared with the assistance of Naasha Loopoo and Alison Chen.