Key takeaways

- Acquisitions cleared under the informal merger review process prior to 1 July 2025 and not put into effect by 31 December 2025 will require an updated informal review from the ACCC before 31 December 2025 to avoid a potential notification being required under the new regime.

- For acquisitions cleared in the informal merger review process between 1 July and 31 December 2025, merger parties will have 12 months from the date of the ACCC's clearance letter to put the acquisition into effect, otherwise the merger may need to be re-notified under the new regime. Similarly, there will be a 12 month period to put into effect merger authorisations granted between 1 July and 31 December 2025.

- Merger parties seeking informal merger clearance from the ACCC from 1 July 2025 need to carefully consider whether the review can be completed in time. The ACCC has indicated that informal merger requests received from October to December 2025 are much less likely to be completed in time. If there is a risk a review will not be complete by 31 December 2025, then the parties should consider voluntarily notifying the ACCC under the new regime.

- Applications for merger authorisation will not be accepted after 30 June 2025.

In more detail

Informal merger reviews

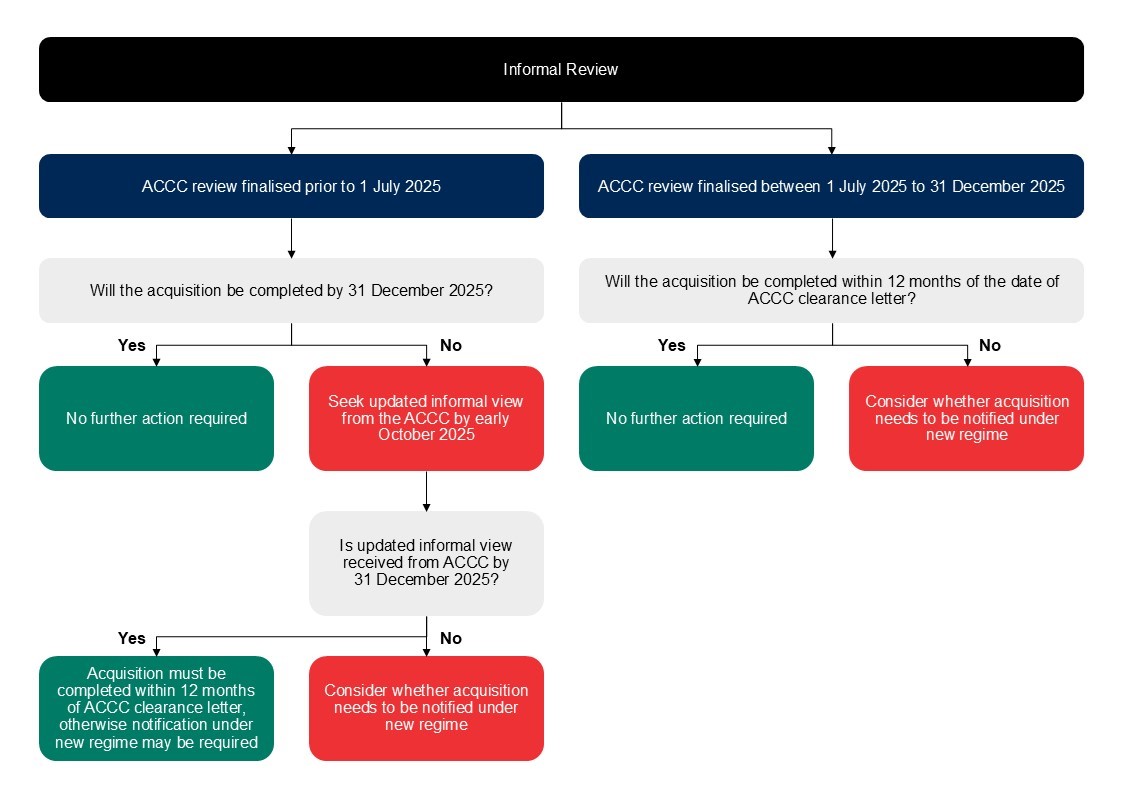

The diagram below sets out the ACCC's transitional arrangements for informal merger reviews.

Informal reviews finalised before 1 July 2025

If the ACCC has granted informal merger clearance before 1 July 2025, there is no obligation to notify under the new regime provided the merger is put into effect before 1 January 2026.

However, if there is a risk that the proposed merger will not be put into effect by the end of this year, the merger parties can request an updated informal view. The merger parties will then have 12 months from the date of a letter from the ACCC confirming it maintains its original view, to complete the transaction without the need to notify under the new regime.

The ACCC strongly recommends that any request for an updated informal view be made by early October 2025 to ensure that the ACCC has sufficient time to complete the review. A request should include an update on any changes (for example, changes in the relevant markets and updated market share). If there are any material changes, the ACCC may conduct a follow-up public review or pre-assessment.

If the ACCC is unable to complete an updated informal review before the end of 2025, and the acquisition is notifiable and meets the merger notification thresholds, it will have to be re-notified or a notification waiver application made. The ACCC will be providing guidance on notification waivers later this year.

Informal reviews between 1 July to 31 December 2025

If the ACCC grants informal merger clearance between 1 July 2025 and 31 December 2025, then the parties will have 12 months from the ACCC's clearance letter in which to complete their merger. However, if an acquisition is not put into effect within this time, and it is a notifiable acquisition that meets the merger notification thresholds, it will have to be re-notified or an application for a notification waiver made.

While the informal merger review system will remain open until 31 December 2025, merger parties are encouraged to submit a request for informal review and engage with the ACCC as soon as possible to ensure that the review is completed by 31 December 2025. If the ACCC has not completed its review by 31 December 2025, then the review will cease.

The ACCC has indicated that applications for informal merger review received between October and December 2025 are much less likely to be considered in time, even if there are limited or no competition risks.

Accordingly, if there is any uncertainty that an informal review will not be completed by 31 December 2025, then merger parties should consider voluntarily notifying the ACCC under the new regime from 1 July 2025.

Merger authorisations

Applications for merger authorisation cannot be made after 30 June 2025.

If the ACCC grants a merger authorisation between 1 July 2025 and 31 December 2025, the parties will have 12 months to put the merger into effect. If the merger is not put into effect within this time, the merger may need to be re-notified if the acquisition is notifiable and meets the merger notification thresholds.

For any merger authorisation applications that have not been finalised by 31 December 2025, the ACCC will cease its review from this date.

Anti-competitive acquisitions

The ACCC has warned that it is wary of the risk of anti-competitive acquisitions occurring during the transition period and has said that it will consider "all available enforcement options" for anti-competitive acquisitions that have completed or planned to complete before or after 1 January 2026 without approval.

This alert was prepared with the assistance of Naasha Loopoo and Alison Chen.