In more detail

Below is a summary of the key changes introduced by the amendment:

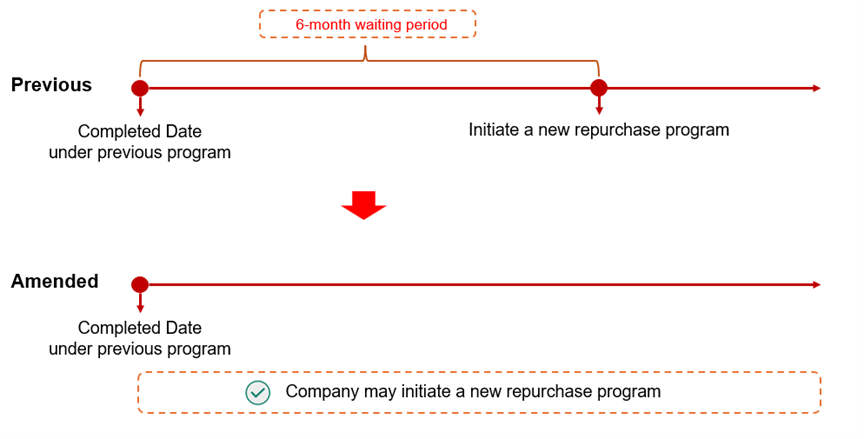

- Elimination of the waiting period for a new repurchase program

Under the previous regulation, a public company was required to wait a period of six months before initiating a new share repurchase program. This waiting period commenced on whichever occurred first: the completion date of the previous share repurchase program, the expiration of the repurchase period under the previous program, or the cancellation date of the previous program ("Completed Date").

The amendment repeals this six-month waiting period, allowing companies to launch a new share repurchase program immediately upon the Completed Date of the previous program.

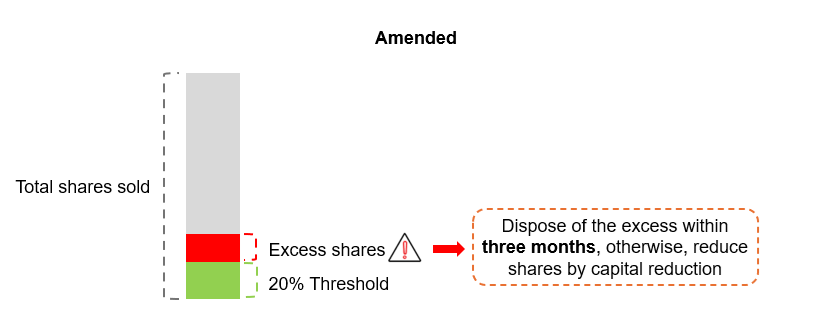

- Cap on treasury shares held

Previously, there was no explicit limit on the number of treasury shares a company could hold. The amendment now imposes the following restrictions:

- A company may hold treasury shares, at any time, up to 20% of its total shares sold ("20% Threshold").

- If the company holds treasury shares in excess of the 20% Threshold, the company must dispose of the excess within three months.

Failure to comply will require the company to reduce its capital by cancelling the excess treasury shares.

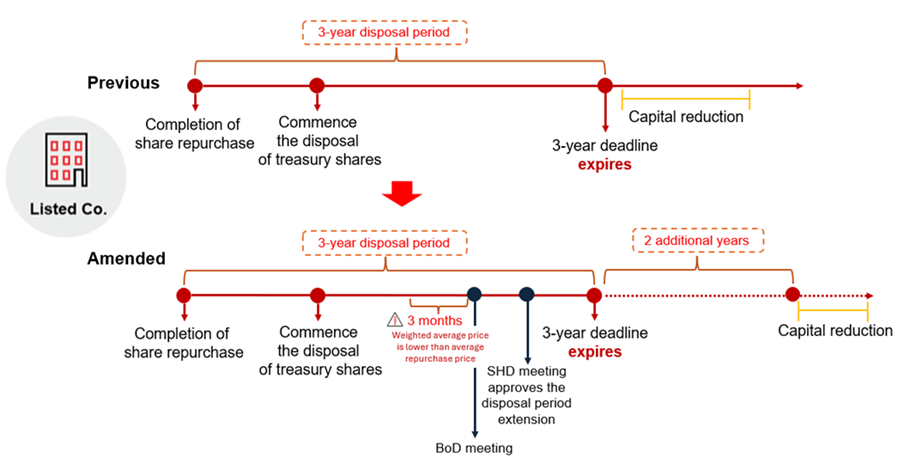

- Extended disposal period for listed companies

Under the prior regulation, public companies were required to dispose of treasury shares within three years from the completion of the share repurchase. The amendment introduces flexibility for companies listed on the Stock Exchange of Thailand by allowing an extension of the disposal period up to two additional years, making the maximum disposal period five years. This extension is allowed only if two conditions are met:

- The company obtains shareholders' approval before the initial three-year period expires.

- The weighted average price of the company's shares during the three months preceding the board resolution to convene the shareholders' meeting is lower than the average repurchased price.

- Transitional provisions

For companies that, prior to the effective date of the amendment, hold treasury shares exceeding the 20% Threshold:

- They may continue to hold the excess shares.

- However, they are prohibited from launching a new repurchase program or, in the case of listed companies, extending the disposal period for existing treasury shares until the holding is reduced to within the 20% Threshold.