Key matters addressed under the New Notification include the following:

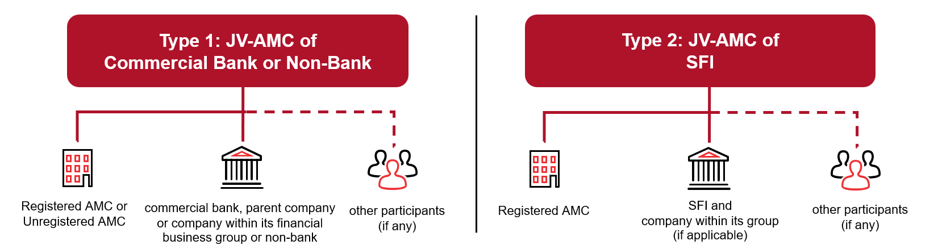

1. Permitted Structure for a JV-AMC

By 7 November 2027, banks, Non-Banks and SFIs have an enhanced ability to establish joint ventures with both asset management companies registered under the law governing asset management companies ("Registered AMCs") or legal entities that perform a similar business but which are not registered as such ("Unregistered AMCs"). This allows financial service providers to maintain a closer relationship with the management and disposition of their transferred assets.

The joint venture asset management companies established under the previous notifications ("Existing JV-AMC") are subject to this New Notification, but the Existing JV-AMCs are not allowed to set up another JV-AMC with banks, Non-Banks and SFIs under this extended scheme.

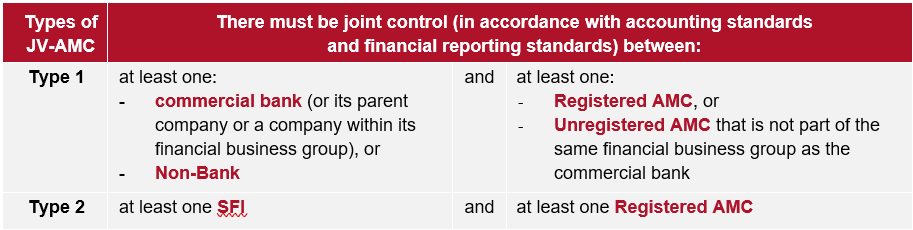

2. Joint Control Requirement

3. Investment Period for JV-AMCs

A JV-AMC will have an operational term not exceeding 15 years from the date of commencement of operation under this New Notification. After the 15-year period, the JV-AMC must proceed with liquidation and closure or restructure its shareholding or ownership in accordance with applicable regulations, unless a waiver is granted by the BOT.

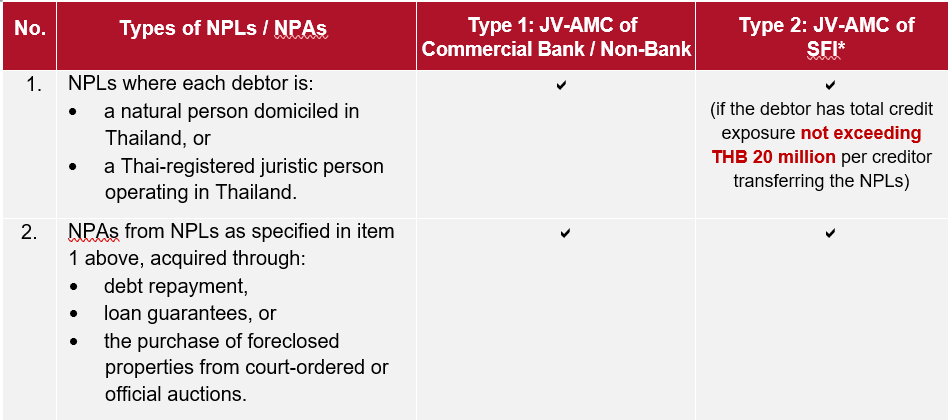

4. Types of NPLs and NPAs Eligible for Acquisition by JV-AMCs

Not all types of NPL or non-performing asset (NPA) can be acquired by all JV-AMCs. Please see the table below for the different types that can be acquired by Type 1 and Type 2 JV-AMCs.

*Remark: NPLs/NPAs acquired by the JV-AMC of the SFI must align with the statutory objectives set forth in the law establishing the SFI.

5. Transfer price

The JV-AMC must acquire the NPLs and NPAs at fair market value.

6. Relaxation of relevant regulations

a. Investment regulations pertaining to commercial banks and Registered AMCs

A commercial bank or its parent company may hold more than 10 percent of shares in JV-AMC, provided that it has joint control in the JV-AMC.

A Registered AMC may invest in JV-AMC and provide financial support to enhance its liquidity, such as by providing loans or offering guarantees.

b. Related lending regulations pertaining to commercial banks

A commercial bank may extend credit, invest, create encumbrances over, or engage in transactions similar to lending with the JV-AMC in which the bank, its parent company, or any company within the financial business group has invested, exceeding 25 percent of the total liabilities of the JV-AMC.

Endnotes

The New Notification develops a transformative framework for NPL resolution, with wide-ranging implications across

the financial sector. Banks, Non-Banks and SFIs would gain enhanced tools to manage distressed assets through JV-AMCs, enabling strategic oversight and improved recovery outcomes. Existing Registered AMCs would benefit from expanded partnership opportunities and access to bank's and SFI's resources, while borrowers may experience better-tailored solutions to manage their debts. This creates new opportunities to better deal with NPLs and NPAs, and we look forward to helping financial entities navigate this extended framework.

For more details, please contact our team at Baker McKenzie.