In more detail

Under both the New Notification and the previous regulatory framework, the general rule remains that:

Any person who, whether directly or indirectly, (i) increases a holding or possession of 5% or more of the total issued shares of a financial institution or a holding company that is the parent of a financial business group, or (ii) reduces such holding or possession to below 5%, including shares held or possessed by that person's related persons, must report the shareholding to the Bank of Thailand in accordance with relevant requirements.

However, the New Notification introduces several key changes that depart from the previous requirements, including:

- Inclusion of shareholdings up to the UBO

- Under the previous regulation, there was no explicit requirement to consider the shareholding of the UBO.

- In contrast, the New Notification requires that the report of direct or indirect shareholding or possession of shares in financial institutions or holding companies must include the shareholdings of all shareholders across all layers of ownership, up to the UBO, as well as the shareholding or possession of shares by any related person of such person.

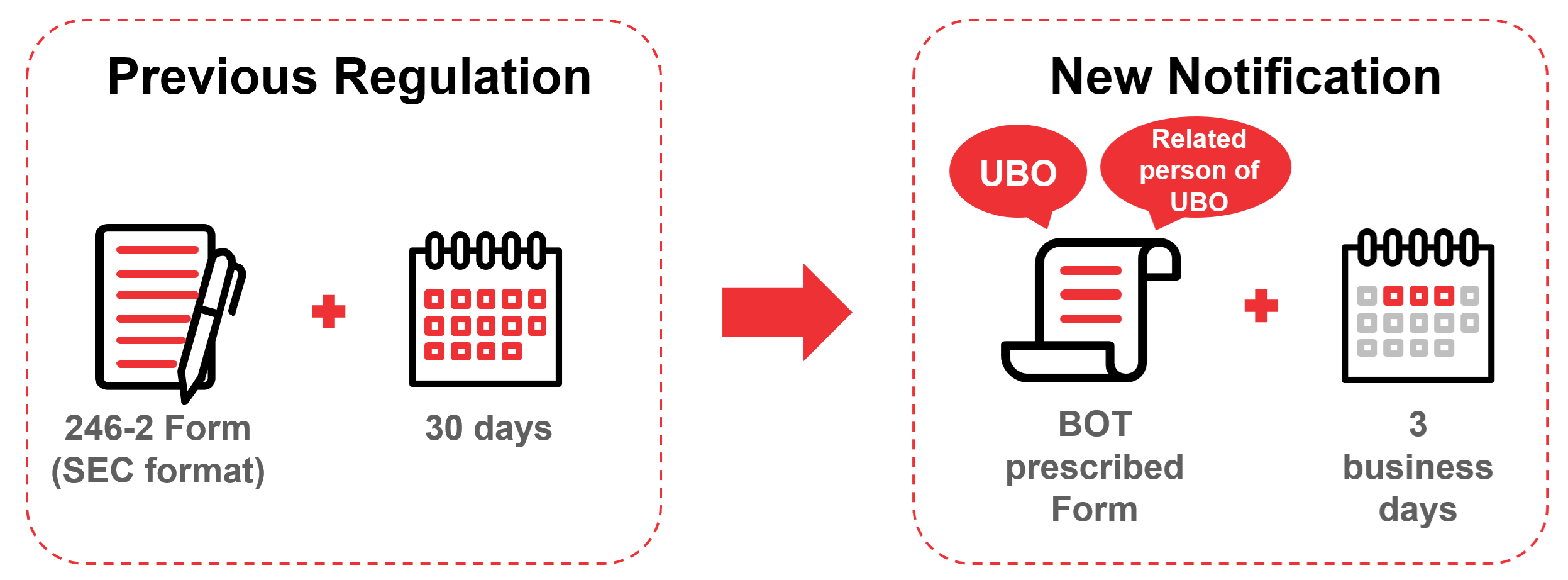

- Transition from the SEC's Form 246-2 to the Bank of Thailand prescribed format

- Under the previous regulation, the Bank of Thailand required that reports on the holding of shares be submitted using the report on acquisition or disposition of securities as prescribed by the Office of the Securities and Exchange Commission ("Form 246-2").

- Unlike the previous regulation, the New Notification requires that the report be prepared strictly in the format prescribed in the Bank of Thailand's publicly available manual, which requires more detailed information than the Form 246-2.

- Acceleration of reporting timeline

- While the previous regulation allowed reports to be submitted to the Bank of Thailand within 30 days from the date of any change in the holding or possession of shares, the New Notification significantly shortens this timeframe, requiring submission within three business days from the date of such change.

- Obligations of the financial institution and holding company

- The financial institution or holding company must have a mechanism to monitor the dominance or controlling behavior of such person and must keep records of such behavior for inspection by the Bank of Thailand or provide such records to the Bank of Thailand upon request.

Endnotes

Given the tightened requirements, investors, financial institutions and holding companies are now compelled to implement robust tracking mechanisms and ensure timely compliance. These changes entail heightened scrutiny, enhanced governance obligations, and may require revisions to how ownership interests within the group are disclosed. Non-compliance with this reporting obligation could lead to a requirement to dispose of the excess portion of shares within 90 days from the date of acquiring such shares, unless a waiver is granted by the Bank of Thailand. Failing such disposal, the Bank of Thailand may petition the court to order the divestment of the excess shares.

For more details, please contact our team at Baker McKenzie.