The Instant Payment Regulation made instant payments fully available in euro to consumers and business in the EU and in European Economic Area countries. It impacted both banks and PSPs, whether they serve consumers or institutional clients.

Since 9 January 2025, the regulation has been directly applicable under Luxembourg law, mandating amendments to national legislation to ensure compliance. The Law addresses access to nationally designated payment systems and central bank accounts and introduces a regime of penalties for non-compliance with the Instant Payment Regulation obligations.

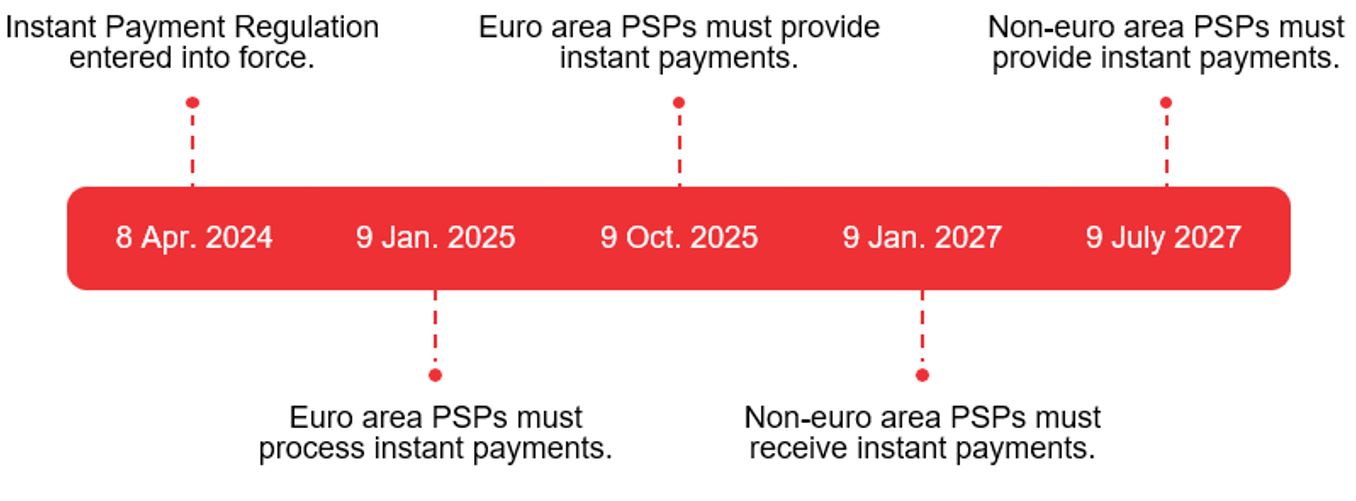

Instant Payment Regulation

The Instant Payment Regulation introduced several key innovations for banks and PSPs, such as the following:

- Instant payments: PSPs are required to offer instant credit transfers in euro alongside standard credit transfers, ensuring that instant payments become a standard service across the EU.

- Payments with 24-7 availability: Instant payments must be available 24-7, allowing transfers within 10 seconds at any time, including outside business hours.

- Cost parity: Charges for instant credit transfers must not exceed those for standard credit transfers.

- Payee verification: PSPs must provide a free service to verify the payee's identity before initiating a transfer. PSPs have to verify that the bank account number and the beneficiary's name provided by the payer match in order to alert the payer of a possible mistake or fraud. PSPs must also verify that their clients comply with the rules on sanctions and financial crime.

- Sanctions screening: PSPs should verify their payment service users immediately after a new or amended financial restrictive measure enters into force. They must also verify, at least once a day, whether any of their payment service users are subject to financial restrictions.

- Access to national payment systems: PSPs and electronic money institutions must have direct access to national payment systems.

- Fund deposits: PSPs and electronic money institutions must be allowed to deposit funds received from payment service users or other PSPs for executing payment transactions in separate bank or central bank accounts.

Key takeaways from the Law

The Law amendeds the Payment Service Law to incorporate the new provisions of the Instant Payment Regulation.

One of the key provisions introduced is the authorization granted to PSPs and electronic money institutions to access central bank accounts. This measure aims to ensure the security of funds received from payment service users or other PSPs for executing payment transactions.

Another important innovation introduced by the Law is the direct access provided to PSPs and electronic money institutions to Luxembourg's national payment system. These changes are designed to address the restrictions imposed by the current provisions of the Settlement Finality Directive (Directive 98/26/EC), which reserve direct participation in national payment systems for investment firms and credit institutions. As a result, PSPs and electronic money institutions have faced limitations preventing their direct involvement in these systems, thereby requiring them to rely on third parties, typically banking institutions.

The Law also established a sanctions regime for breaches of the requirements for euro transfers. These measures aim to improve the operational efficiency and competitive advantage of electronic money institutions and PSPs while safeguarding user funds.

Practical implications

The implementation of the Instant Payment Regulation had several practical effects on PSPs, requiring them to adopt a proactive approach to comply with the new payment framework.

PSPs should do the following:

- Upgrade their systems to handle real-time processing and ensure compliance with the new standards.

- Enhance their systems for 24/7 availability and instant payment processing.

- Revise their contracts with clients and third-party providers to reflect the Instant Payment Regulation new requirements.

- Reinforce verification and compliance processes for new payees.

- Implement robust compliance systems to ensure timely and accurate screenings.

Timeline