In more detail

Digital taxation regimes across Africa typically apply to both business-to-business (B2B) and business-to-customer (B2C) transactions, capturing revenue from a broader base of economic activities. These regimes often vary in degrees of enforcement and compliance requirements.

In South Africa, there is currently no distinction between B2B and B2C supplies. Therefore, non-resident suppliers must account for VAT on electronic services supplied to South Africa-based customers if they meet the registration requirements (for further information, see South Africa: Practical considerations for foreign suppliers of electronic services to South African customers published on 24 January 2023). The Draft Taxation Laws Amendment Bill and accompanying Regulations published on 1 August 2024, proposed several amendments to the VAT regime, including the regulations governing the foreign supply of electronic services to South African customers ("Regulations"). One of the key proposals is the introduction of a certain B2B exclusion aimed at streamlining the VAT system for non-resident suppliers with no physical presence in South Africa and promoting taxpayer compliance.

Proposed Regulation 2(d) provides that services supplied from an export country by a non-resident of South Africa will be excluded from the current electronic services supply (ESS) regime when these services are supplied "solely" to registered VAT vendors in South Africa. This means that a foreign supplier of electronic services to a registered VAT customer ("qualifying B2B") would no longer be required to register for and charge ESS VAT on the supply of electronic services in South Africa (i.e., qualifying B2B supplies made by a non-resident supplier will not be subject to the ESS regime). However, there are uncertainties surrounding the interpretation and practical application of these amendments.

With the implementation of the proposed changes, non-residents who supply electronic services to South African qualifying B2B customers should not subject to the South African ESS VAT regime. However, the question still remains whether this exclusion is exclusively available to non-residents who only make qualifying B2B supplies, excluding those who make a mix of qualifying B2B, B2B and B2C supplies (combination supplies) regardless of the proportion of each in the total supplies made to South Africa. On the other hand, qualifying B2B customers would have no VAT liability in respect of the electronic service procured. Consequently, no input tax deduction would need to be made, thus eliminating the respective administrative burden and promoting the efficiency of the VAT system.

Practically, a distinction must be made between "imported services" and "electronic services", which are separate concepts that may cause confusion if conflated. Without detracting from the main subject of this article, an "imported service" refers to a service provided by a non-resident supplier or a supplier carrying on a business outside South Africa to a South African customer where these services are used or consumed locally for non-taxable purposes. For example, if a South African company employs a foreign law firm to provide legal advice or representation, this service may be considered an imported service to the extent that there is no link between the services acquired and the taxable supplies made by that company. Imported services are out of scope of the ESS regime (i.e., the non-resident supplier would neither have a VAT registration obligation in South Africa nor be required to levy VAT on that supply). In this scenario, the resident recipient must declare and pay VAT on the imported service to SARS but would not be entitled to an input VAT deduction since the services are not acquired for taxable purposes. Thus, a domestic reverse-charge mechanism applies with respect to imported services but is irrelevant for the purposes of the ESS regime.

Proposed changes and interpretive challenges

The proposed amendments aim to distinguish between qualifying B2B and B2C supplies and to exclude qualifying B2B supplies from the scope of the ESS regime. Specifically, it is proposed that services supplied by a non-resident "solely" to registered VAT customers in South Africa would be removed from the ESS regime. This implies that a non-resident must supply services exclusively to registered VAT customers to satisfy the qualifying B2B exemption requirement, and that non-residents making combination supplies would not enjoy the qualifying B2B exemption by virtue of the B2C supplies or other non-qualifying B2B supplies and would thus be required to account for VAT on all electronic services supplied to resident customers in South Africa.

While the draft Regulations do not provide clear guidance on how to manage those scenarios, discussions between SARS and industry stakeholders appear to be leaning toward the view that the exclusion is only available to non-residents who exclusively supply to registered VAT vendors. It is also unclear whether SARS will require any documentation to evidence that the exclusion applies or whether non-resident suppliers can unilaterally assess a customer in order to determine whether the supplier would have any ESS VAT obligations.

In light of this potential change, non-resident electronic services suppliers who are currently registered for VAT in South Arica should consider:

- Updating its Know-Your-Client document to cover the customer's VAT registration status in South Africa.

- Reviewing its service offerings to determine if it is currently restricted to certain group of customers (e.g., B2B).

- Assessing its customer profile in South Africa. To the extent that majority of its customers are qualifying B2B transactions, it should consider the impact where limited supplies are made to non-qualifying B2B customers or individual customers.

An African continental perspective

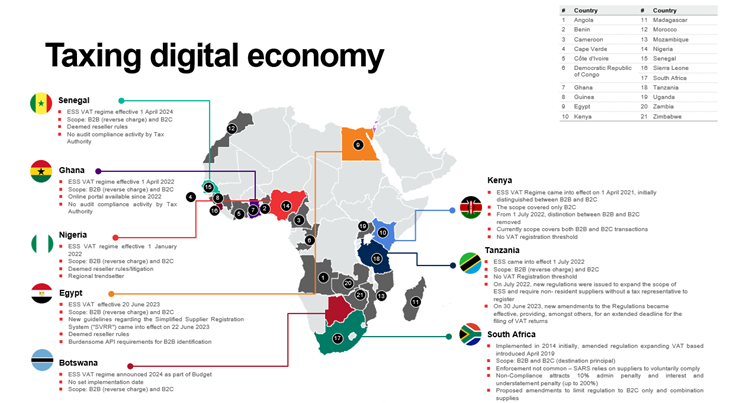

Several African jurisdictions have implemented VAT regimes for electronically supplied services. As indicated earlier, these regimes typically cover both B2B and B2C transactions, with varying degrees of enforcement and compliance requirements as there is no uniform approach to taxing the digital economy across the African continent. Out of the 54 countries on the African continent, 21 have already enacted rules for charging VAT on ESS, with some jurisdictions expected to join soon. A high-level overview of the ESS regime in Africa is generally as follows:

Conclusion

The proposed VAT reform in South Africa introduces significant changes to the ESS regime, particularly with the introduction of the B2B exclusion. While the aim is to simplify VAT compliance for foreign suppliers, the proposed rules present several interpretative challenges, especially for non-residents making combination supplies. We hope for increased engagement between the National Treasury, SARS and all relevant stakeholders to address these concerns and urge taxpayers to seek professional advice to prepare for how these proposals, when implemented on 1 April 2025 (as announced), will affect their businesses.

*****

Ayanda Mavata, Trainee Solicitor, has contributed to this legal update.