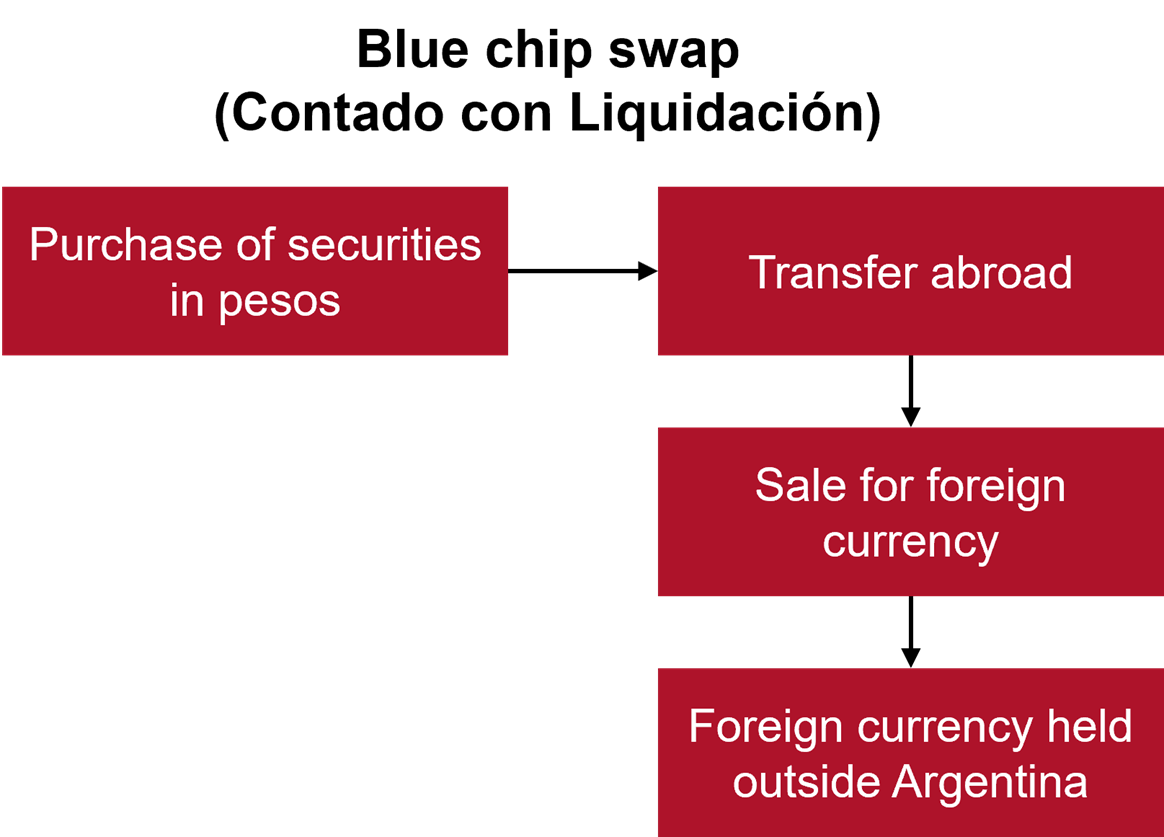

CCL mechanism

- Purchase of securities in Argentine pesos: An individual or company buys Argentine securities (such as stocks or bonds) in the local market using Argentine pesos.

- Transfer abroad: These securities are then transferred to a foreign account, typically in a jurisdiction like the US.

- Sale for foreign currency: Once abroad, the securities are sold for US dollars or another foreign currency. The resulting funds are now held outside Argentina.

This process allows participants to effectively convert Argentine pesos into dollars without going through the official exchange market.

In April 2025, the Argentine government lifted several restrictions, allowing Argentine tax resident individuals to freely access both the official Foreign Exchange (FX) market and the CCL market without any restrictions. As a result, Argentine tax resident individuals may now buy US dollars with Argentine pesos without having to go through the CCL.

However, depending on the volatility of government bond quotations, the CCL may prove to be a more cost-efficient option than going through the FX market. In practice, Argentine financial institutions normally charge a percentage fee on the amount of a wire transfer, which can exceed the spread incurred when trading government bonds through the CCL.

Argentine tax resident individuals who still prefer to use the CCL mechanism rather than the official FX market may benefit from a precedent set by the Federal Administrative Litigation Chamber (Sala V) in the case Besfamille, Martin (TF 46925-I) v. Dirección General Impositiva. The ruling confirmed that Argentine tax resident individuals are not subject to income tax on gains derived from the sale of government bonds.

Background of the court precedent

An Argentine tax resident was challenged by Argentina’s tax authority (ARCA, formerly AFIP) over his 2008 income tax declaration. The dispute centered on whether profits from CCL operations (i.e., buying government bonds in pesos and selling them in dollars abroad) were exempt from income tax under Article 20, subsection w) of the Income Tax Law.

Initial ruling

The Tribunal Fiscal de la Nación (Sala B) upheld the tax authority’s position.

- It ruled that, under the economic reality principle, the operations were not exempt because they were nearly simultaneous and did not reflect typical market behavior.

- It considered the Argentine tax resident as an intermediary, not a direct investor.

Appeal and final decision

The Argentine tax resident appealed to the Federal Administrative Litigation Chamber (Sala V), which revoked the Tribunal Fiscal de la Nación’s decision.

- The Chamber emphasized the principle of legality, stating that the law does not require a minimum holding period or prohibit immediate transactions.

- It ruled that the exemption in Article 20, subsection w) applies objectively to such operations, as long as the taxpayer is not acting as a commercial intermediary.

- The Chamber found that the Argentine tax resident acted as a direct investor, rather than on behalf of others.

- It also rejected the application of the economic reality principle used to reclassify the transactions as taxable.

- The Chamber concluded that no additional requirements beyond those explicitly stated in the law can be imposed to deny the exemption.

Significance

This ruling sets a precedent that personal investments using CCL are exempt from income tax, provided they meet the legal criteria and are not part of a commercial activity.