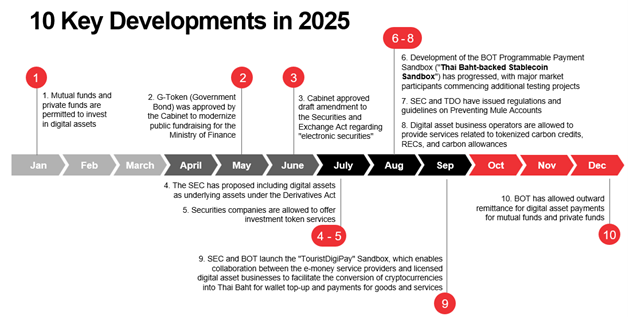

Beyond stablecoins, Thailand's regulatory landscape marked other key milestones in 2025. We have identified 10 significant developments shaping Thailand's digital asset framework, which include, among others, the Government Token ("G-Token"), the "TouristDigiPay" Sandbox, and the permission for digital asset business operators to provide services related to tokenized carbon credits and tokenized renewable energy certificates (RECs).

In more detail

Key developments of Thailand Digital Asset Regulatory Framework are summarized as follows:

January

- Mutual funds and private funds are permitted to invest in digital assets

In December 2024, regulations on fund investments were revised. Effective 16 January 2025, the Securities and Exchange Commission (SEC) allows mutual and private funds to invest in digital assets, including cryptocurrencies and investment tokens, under specified criteria.

May

- G-Token (Government Bond)

The Government Token (G-Token) is a government debt which was approved by the Cabinet on 13 May 2025 under the Public Debt Management Act B.E. 2548 (2005) and supported by the Emergency Decree on Digital Asset Businesses B.E. 2561 (2018) ("Digital Asset Decree"). This is a major financial innovation designed to modernize public fundraising for the Ministry of Finance. Unlike traditional government bonds, this G-Token will be able to be traded on licensed digital asset exchanges and brokers under SEC supervision.

June

- Approving a draft amendment to the Securities and Exchange Act regarding "electronic securities"

On 10 June 2025, the Cabinet approved a draft amendment to the Securities and Exchange Act to introduce electronic securities and acknowledged the roadmap for related subordinate regulations proposed by the Ministry of Finance. This initiative lays the foundation for Thailand's capital markets to fully embrace digitalization, enabling easier trading of securities such as equities, investment units, and debt. The framework will leverage technology (e.g., blockchain technology) for recording and managing transactions, ensuring transparency, security, and auditability.

July

- Including digital assets as underlying under the Derivatives Act

On 21 July 2025, the SEC issued a public hearing on proposed amendments to the Derivatives Act B.E. 2546 (2003) ("Derivatives Act"), as amended, aiming to include digital assets as regulated underlying. If adopted, any entity wishing to offer or trade digital asset derivatives must obtain the relevant derivatives business license and comply with applicable requirements. For instance, a licensed digital asset exchange that wishes to list digital asset derivatives would need a derivatives exchange license and meet the on-going requirements under the Derivatives Act.

- Securities companies are allowed to offer investment token services

On 9 July 2025, the SEC issued new regulations enabling securities companies (i.e., broker and dealer) to provide trading and exchange services for investment tokens. These regulations aim to leverage the capabilities of traditional securities firms to support the investment token ecosystem while ensuring robust risk management and operational standards. These services are not considered digital asset brokerage or dealing businesses under the Digital Asset Decree and therefore do not require digital asset business licenses, provided that securities companies comply with the conditions prescribed under the Securities and Exchange Act.

August

- Development of the BOT Programmable Payment Sandbox

Initiated in 2024, the BOT's Programmable Payment Project under the Enhanced Regulatory Sandbox, commonly referred to as the "Thai Baht-backed Stablecoin Sandbox", had significant expansion in 2025. Following the initial trial in 2024, the second half of 2025 saw the commencement of testing by major market participants, focusing on further use cases such as escrow payments and asset tokenization payments. The BOT is currently holding close consultations with market participants to develop a regulatory framework for Thai Baht-backed stablecoins.

- SEC regulations and TDO guidelines on preventing mule accounts

Given concerns about the use of digital assets for money laundering and scams, the SEC and the Thai Digital Asset Operators Trade Association (TDO) have issued regulations and guidelines on KYC procedures. These require digital asset business operators to classify customers identified as owners of "black", "dark gray", or "light gray" mule accounts as high-risk customers. Measures include rejecting account openings, suspending deposit and withdrawal services for digital assets and Thai Baht, and applying tier-based restrictions depending on the mule account category.

- Digital asset business operators are allowed to provide services related to tokenized carbon credits, RECs, and carbon allowances, subject to the SEC's prior approval

On 20 August 2025, the SEC issued a notification allowing digital asset exchanges, brokers and dealers to provide services (i.e., listing, and trading) related to Tokenized Carbon Credits, Tokenized RECs, and Tokenized Carbon Allowances. However, prior to providing such services, the digital asset business operators must obtain the SEC's approval to conduct this additional business and implement robust systems for token screening and disclosure standards to ensure adequate information transparency and risk management.

September

- TouristDigiPay Sandbox: Bridging digital assets and tourism payments

The TouristDigiPay Sandbox project is a joint initiative by the BOT and SEC. This sandbox enables collaboration between the e-money service providers and licensed digital asset businesses to facilitate the conversion of cryptocurrencies into Thai Baht for wallet top-up and payments for goods and services. The testing period spans 18 months. This initiative aims to integrate the digital asset ecosystem with Thailand's mainstream tourism payment infrastructure, supporting local commerce while maintaining sufficient risk management and consumer protection measures.

December

- Allowing outward remittance for digital asset payments for mutual funds and private funds

Effective 1 December 2025, the Notice of the Competent Officer Re: Rules and Practices regarding Currency Exchange (No. 34) allows remittances of funds for payments for digital assets to a non-resident where the payments are made by mutual funds or private funds, and such digital assets are not linked to the Thai Baht, without prior approval. Previously, outward remittances for digital asset payments were generally prohibited. However, under the new regulations, mutual and private funds may now make these transfers in accordance with the SEC's framework, which allows mutual funds and private funds to invest in digital assets.

Endnotes

These 10 developments in 2025 reflect Thailand's accelerated transition toward a digital financial ecosystem and aim to modernize its investment and payment infrastructure.

Our upcoming client alert will cover developments in Central Bank Digital Currency (CBDC), stablecoins, tokenized deposits, and related sandbox initiatives, highlighting regulatory directions that reflect Thailand's integration of digital assets into payment systems. Businesses operating in the digital asset and payment sectors should closely monitor these regulatory updates and prepare to comply with evolving legislation to avoid missing opportunities as Thailand moves toward a fully digitalized financial market.

For more details, please contact our team at Baker McKenzie.