Types of trusts

According to the Swiss law proposals, a trust is a contractual relationship that has no legal personality. The trust is a legal concept of Anglo-Saxon origin that provides, most commonly based on a constitutive document ("Trust Deed"), for the transfer of assets from a settlor to the Trustee. The Trustee has powers of disposal over the trust's assets under civil law, but must manage and use them according to the purpose established by the settlor in favor of the trust's beneficiaries (without any power of disposal over the assets but with the benefit of the "equitable interest"). Under English common law, the trust represents a relationship, under which the legal and beneficial/economic ownership of an asset is split, with the legal owner ("Trustee") being bound to manage the asset in the interests of the beneficiary (beneficial or economic owner). Trusts can be created not only by way of legal documentation but also by operation of law: English law recognizes "constructive" and "resulting" trusts that impose a Trustee relationship on parties pending completion of the overall transaction (e.g., sale of a property subject to a sale and leaseback, or exchange of contracts on a property transaction), or when a transaction fails and the asset is to be returned to the seller.

There are various trust arrangements that can generally be classified into three basic categories, namely:

- Revocable trust

- Irrevocable discretionary trust

- Irrevocable fixed interest trust

Under a revocable trust, the settlor retains the right to alter or even to revoke the trust. Accordingly, the settlor is not permanently impoverished and retains access to the trust's assets.

Under an irrevocable discretionary trust, the settlor permanently divests himself of their assets and, in principle, no longer has any rights or obligations over the trust assets. It is not known in advance when the beneficiaries will receive a benefit from the trust, to what extent and at what time. The beneficiaries therefore have no enforceable claim against the Trustee.

In the case of an irrevocable fixed interest trust, the settlor is permanently impoverished. The person no longer has any rights or obligations in connection with the trust's assets. The Trustee has no discretion as to the allocation of the income and/or assets of the trust, as the extent and nature of the distributions are fixed in the Trust Deed.

Swiss VAT treatment

As mentioned, trusts have no legal personality. Therefore, they cannot be directly subject to VAT and are to be considered transparent for tax purposes. This makes it difficult to determine the place of supply for VAT purposes.

For a revocable trust, if the majority of the settlors are domiciled in Switzerland (head count principle), the trust is attributed to Swiss territory. The services provided to the trust are therefore deemed to be provided on Swiss territory (principle of destination), and the tax treatment depends on the nature of the services. If the majority (more than 50%) of the settlors are domiciled abroad, the trust is then attributable to a foreign country and the services provided to the trust are therefore deemed to be provided abroad, without being subject to Swiss VAT. It should be noted that general clauses establishing a contingent beneficiary, such as a nonprofit institution, do not influence the determination of the geographical allocation of the trust.

For an irrevocable trust, both discretionary or fixed interest, the same logic for a revocable trust applies, except that the geographical allocation depends on the location of the beneficiary and not on the location of the settlor. In addition, if the beneficiaries cannot be determined, the domicile of the Trustee(s) must be relied upon to determine the territorial allocation of the trust.

In addition, if foreign companies not registered for Swiss VAT purposes are providing services to a trust attributable to Switzerland (whether revocable or irrevocable), the acquisition of these services (with the exception of telecommunication or computer services to recipients who are not subject to VAT) is subject to the reverse charge procedure for the settlor (revocable trust), as well as for the Trustee or the beneficiary (irrevocable trust).

In practice, Swiss financial institutions are often involved as asset managers managing the trust's assets. As wealth management services are subject to Swiss VAT, the question of the place of supply of the service arises. A service provided in Switzerland will be subject to Swiss VAT of 7.7%, while a service provided abroad will be exempt.

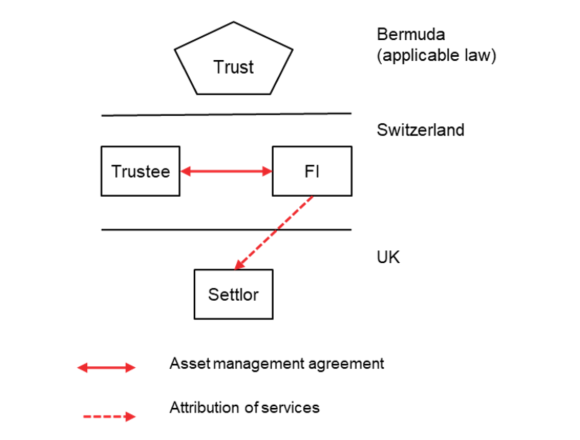

Example 1: Revocable trust with a UK-domiciled settlor: A Swiss-based financial institution is mandated by the Trustee to provide asset management services.

The place of supply of the services rendered by the Swiss financial institution is deemed to be outside Switzerland and is therefore not in the scope of the Swiss VAT.

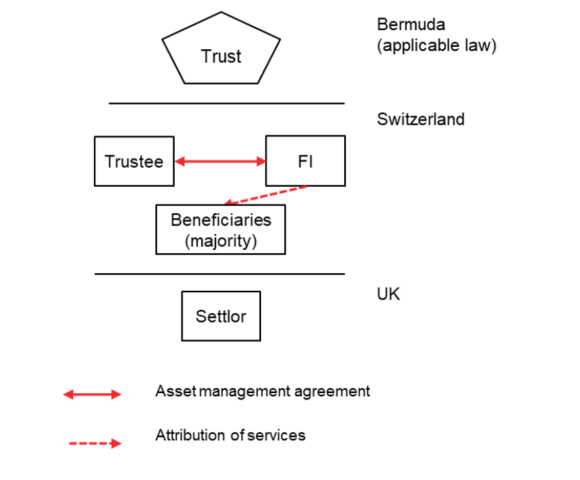

Example 2: Irrevocable trust (discretionary or interest fixed): Settlor is based in the UK and the majority of the beneficiaries are located in Switzerland. Swiss-based financial institution is mandated by the Trustee to provide asset management services.

The place of supply of the services rendered by the Swiss financial institution is deemed to be in Switzerland, and therefore the services are subject to Swiss VAT of 7.7%.

Treatment of trusts under other jurisdictions

UK VAT law

Despite the trust being widely recognized under English law, VAT law (deriving as it does from the principal VAT directive and civil law) does not clearly recognize the trust in determining the VAT implications of a given transaction. As a general rule, while English common law protects the beneficiaries of a trust, VAT rules look to the legal owner when determining the place of supply, as set out above under Swiss rules. English trusts do not have legal personality, and so the legal owners are dealt with under basic principles (as an individual/company or a partnership).

However, UK VAT law explicitly recognizes the split of beneficial ownership with respect to real estate. In this respect, the beneficial owner is treated as the supplier of land for VAT purposes, rather than the legal owner or Trustee, and also has the right to recover input VAT on costs incurred by the Trustee.

Trusts are also common in pension fund arrangements, under which both legal and beneficial owners can experience difficulties in recovering VAT given the lack of explicit legislative guidance.

German VAT law

Under German corporate law, depending on its structure and purpose, a trust can either be considered to be a legal person who is able to conclude contracts with third parties or as a non-legal person. This is true for both private and public trusts. A trust that is considered as a legal person can be a taxable person for VAT purpose depending on its activities. For instance, a trust that merely uses its funds to invest and trade in securities generally is not considered as a taxable person. Applying the case law on VAT implications for financial holdings, a trust performing activities that, by their very nature solely yield dividends, are not equivalent to supplies carried out for a consideration. On the other hand, a trust that uses assets to make supplies of goods or services for a consideration (e.g., leasing real estate to third parties for a fee) engages in a taxable activity, and therefore is considered as a taxable person. Services that are rendered to a trust that is not a taxable person are generally deemed to be rendered at the place where the service provider has established its business. When services are rendered to trusts that are considered as taxable persons, the place of the service is generally deemed to be the place where the management board of the trust is performing the routine decision-making on behalf of the trust. As an exception, a nontaxable trust that has obtained a VAT ID number from the German tax authorities, for assessing the place of services, is being treated as a taxable person as well. In those cases, services rendered by foreign supplies may fall under the reverse charge mechanism (where the trust would be liable for German VAT instead of the supplier). Special VAT placing rules may override these basic principles. For instance, a lease of real estate is taxable at the place of the property regardless of whether the trust is a taxable person.

Spanish VAT law

There are no Spanish regulations addressing the status of trusts from a VAT perspective. Trusts are not common structures used in Spain to either carry out business activities in Spain or to hold assets in Spain, since Spanish civil law does not recognize trusts as having own legal personality. Therefore, trusts are generally disregarded for direct tax purposes.

Spanish Tax Authorities are used to referring to EU case law when interpreting the VAT taxpayer concept (CJEU cases C-155/94 Wellcome Trust Ltd., C-60/90 Polysar, C-333/91 Sofitam and C-16/00 Cibo Participations, among others), referring to a trust case. Based on such case law, Spanish tax authorities have the position that the mere acquisition and holding of shares in a company is not to be regarded as economic activities if it is not accompanied by direct or indirect involvement in the management of the companies. Such conclusion has been recently used by the Administrative Central Court to conclude that a pension fund shall not be considered as a VAT taxpayer as long as:

[…] it does not carry on a business activity, on its own account and with its own resources intervening in the distribution of goods or services. The pension fund is separate and independent of the entities that promote and manage them, lacking legal personality, with specific tax regulations and made up of resources owned by the participants, although they are managed by the management entity contracted for this purpose, for whose activity they receive remuneration. Its income is derived solely from interest, dividends or changes in the assets of its own assets, which are not in the nature of an economic activity. (TEAC rec. 03722/2018)".

By the same logic, a trust could be a taxable person depending on its activities (i.e., for instances if it engages in economic activities with its own resources intervening in the distribution of goods and services). The VAT location rules applicable to services supplied to trusts will therefore vary depending on the trust being a taxable person or not for VAT purposes, and having obtained or not a VAT number in Spain.