Key takeaways

-

Increased Tax Audit Scrutiny: The GTA are broadening their audit focus beyond traditional Patent/IP Box regimes to also include intra-group payments to US licensors benefiting from the FDII regime.

-

Proactive Compliance: Businesses with German subsidiaries or branches paying royalties to related parties abroad should review their intra-group licensing transactions and assess potential exposure to the RBR to ensure compliance and mitigate risks.

-

Litigation Prospects: The RBR has been criticized for being overly broad and potentially disproportionate, which raises concerns about its constitutionality and compatibility with EU law. The prospects of success for taxpayers challenging the RBR before the German tax courts appear to be fairly promising.

In depth

The RBR, which came into effect on 1 January 2018, limits the deductibility of royalty expenses incurred by German businesses if the direct or (in the case of a back-to-back licensing structure) indirect licensor is a related party whose income is subject to a deviating low taxation (the "Preferential Regime"), unless such Preferential Regime complies with the Modified OECD Nexus Approach. The threshold for low taxation is 25% for royalty expenses that accrued until 31 December 2023 and 15% thereafter. The RBR applies irrespective of anti-discrimination clauses in Germany's Double Tax Treaties (DTTs).

Originally introduced by the German legislator with the intention to address the tax challenges posed by traditional Patent/IP Box regimes offering low tax rates and/or (partial) tax exemptions without requiring qualifying R&D activities in the country, the scope of the RBR could well extend beyond these specific regimes. In particular, its broad wording means that it could potentially also apply to preferential tax regimes that do not specifically target royalty income, as long as royalty income also benefits from such a regime.

Although the RBR has been in force for several years, its impact has been fairly limited in practice as the GTA have so far mainly focused on audit periods prior to the RBR's introduction in 2018. However, recent audit activity indicates a shift, with the GTA now increasingly scrutinizing cross-border royalty payments to related parties in 2018 and subsequent years for a potential application of the RBR.

Importantly, the GTA focuses not only on royalty payments to traditional Patent/IP Box jurisdictions. Other types of tax regimes such as the Swiss regime for cantonal special purpose vehicles (valid until 31 December 2019) are also considered by the GTA to be Preferential Regimes within the meaning of the RBR that do not comply with the Modified OECD's Nexus Approach. In addition, the GTA expressed their view in a 2022 circular on the RBR that even "tax rulings" can fulfil the requirements of a Preferential Regime in terms of the RBR.

Another rising hot topic in German tax audits is the application of the RBR to royalties paid to licensors in the US that benefit from the FDII regime. While the argument that FDII could be a Preferential Regime under the RBR is not new, the GTA's current focus on FDII comes unexpected for many observers, as FDII is still classified as a regime under further review by the OECD's Forum on Harmful Tax Practices as well as in the GTA's most recent circular. According to said circular, the GTA do (yet) not require taxpayers to apply the RBR in these situations.

At the same time, there are rumors that tax field auditors have been instructed by a decision of representatives of the Federal Ministry of Finance and the ministries of finance of the 16 federal states to take up all cases where payments are made to licensors who benefit from a regime under further review (such as FDII), if there is otherwise a risk that the tax claim could become time-barred or that the ability to amend the tax assessment could be forfeited. Both is usually the case following a tax audit, as the statute of limitations expires and the opportunity to amend the tax assessment usually is lost.

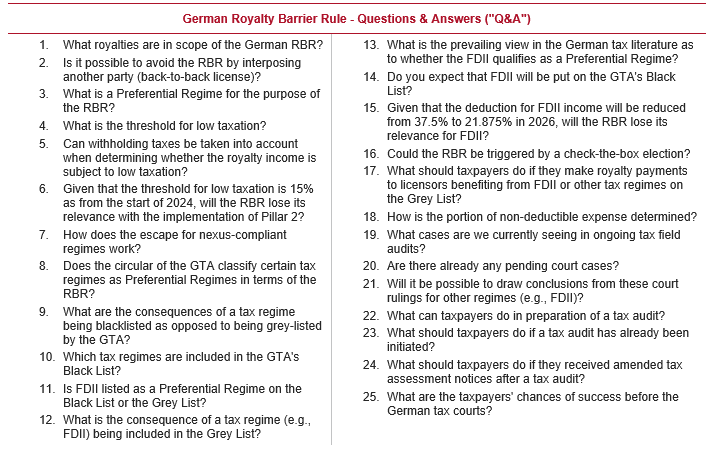

To help you navigate through this complex landscape, we prepared a detailed Q&A that outlines the scope and implications of the RBR, incorporating the latest guidance from the GTA dated 5 January 2022 and 6 January 2022. We encourage you to use this information to assess the potential impact on your business and to ensure compliance with the current regulations.

Should you have any questions or require further assistance, please do not hesitate to contact us.

Click here to read the full alert.